EOBI Pension Increase

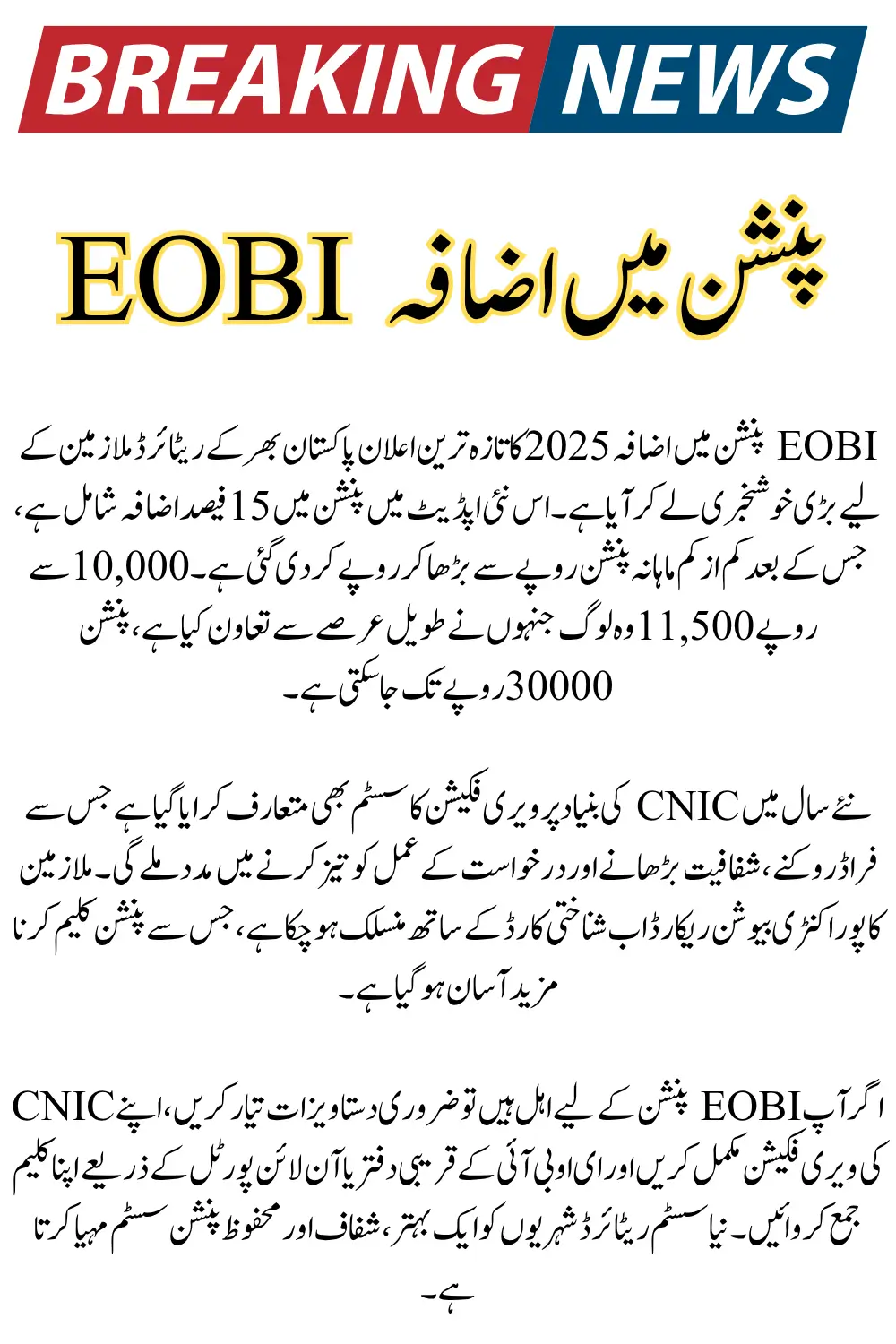

EOBI Pension Increase 2025 has brought a major wave of financial relief for thousands of retired workers across Pakistan, as the Employees’ Old-Age Benefits Institution (EOBI) rolls out its latest reforms. With a higher monthly pension and an upgraded CNIC-based verification system, the government aims to make the pension process more transparent, secure, and accessible for private-sector employees.

The updated structure not only strengthens financial stability for senior citizens but also ensures that only genuine and eligible beneficiaries receive their payments. If you’re planning to apply for an EOBI pension or want to understand the new verification process, this guide explains everything in simple language.

Understanding the EOBI Pension System

EOBI is a federal institution created to protect private-sector employees after retirement. Its core purpose is to ensure that every registered worker receives a guaranteed monthly income once they complete their service years.

Under this system, employers register their workers, contribute monthly payments, and maintain employee records. In return, EOBI provides old-age pensions, invalidity pensions, survivors’ pensions, and old-age grants. This structure works like a long-term financial safety net for workers who spent their lives contributing to the economy.

Also Read: CM Punjab Announces Ration Card 2025 — Who Can Apply & How to Get Rs 3000 Monthly

EOBI Pension Increase 2025 – What’s New?

The 2025 update brings a major relief package for retired workers:

Increase in Monthly Pension

The minimum pension has been increased from Rs. 10,000 to Rs. 11,500, reflecting a 15% raise. Long-term contributors can now receive up to Rs. 30,000 depending on their contribution record.

Better Coverage for Informal Workers

Domestic workers, semi-formal laborers, and agriculture workers are now being brought under EOBI’s umbrella through streamlined registration and employer-linked contributions.

Improved Digital System

The new CNIC verification system ensures transparency, reduces fraudulent claims, and links your entire employment history to your national ID number.

Who Is Eligible for the 2025 EOBI Pension?

To claim EOBI pension, you must meet the official criteria:

Employer Registration Required

You must have been registered by your employer in the EOBI system.

Contribution Requirement

A minimum of 15 years of contribution is mandatory for pension eligibility.

Age Criteria

- Men: 60 years

- Women: 55 years

Not Receiving Another Government Pension

Anyone already taking another state pension cannot apply for EOBI benefits.

These conditions ensure that genuine retired employees receive the maximum protection.

Also Read: Good News! A big drop in Gold Price In Pakistan, How Much Has Gold Become Per Tola?

New CNIC Verification System – How It Works

The updated digital verification process is one of the biggest improvements introduced in 2025.

Why CNIC Verification Matters

Your CNIC now carries your entire EOBI history — registration details, contribution record, and employer data. This prevents fake claims and makes the application process faster.

How Employers Are Involved

Employers must ensure that employee details match NADRA records to avoid delays during pension approval.

Step-by-Step Guide to Check Eligibility & Verify CNIC

Step 1: Collect Required Documents

Prepare the following:

- Valid CNIC

- Employment certificate

- Contribution record

- Bank account details

- Passport-size photos

- Filled pension form (PE-02 / A-6)

Step 2: CNIC Verification

Visit your nearest EOBI regional office or online facility (if available) to verify your CNIC. Your contributions will be matched against the EOBI digital database.

Step 3: Eligibility Confirmation

Once verified, EOBI officers will confirm your employment history, total contribution years, and age.

Step 4: Start Receiving Pension

After approval, your monthly pension will be transferred directly to your bank account.

Also Read: Imam Masjid Wazifa Apply Online – 25000 Per Month Stipend For Imam Masjid

Updated Pension Rates: 2024 vs 2025

| Pension Category | 2024 Amount | 2025 Updated Amount |

|---|---|---|

| Minimum Pension | Rs. 10,000 | Rs. 11,500 |

| Maximum Pension | Rs. 26,000–28,000 | Up to Rs. 30,000 |

Benefits of EOBI Pension for Senior Citizens

✓ Guaranteed Monthly Income

Provides financial stability during retirement.

✓ Transparent, Contribution-Based System

Ensures fairness and proper distribution of funds.

✓ Federal Legal Protection

EOBI pensions are backed by law under federal supervision.

✓ Family Benefits

Survivors’ pension supports widows, orphans, or dependents of deceased workers.

Tips for a Smooth EOBI Pension Application

- Update your CNIC before applying

- Verify your employer registration annually

- Keep all employment letters and contribution slips safe

- Apply 2–3 months before reaching retirement age

Also Read: Honda CG 125 Gold Installment Plan Via Meezan Bank Step by Step Guide

Conclusion

The EOBI Pension Increase 2025 is a major step towards ensuring dignity and security for retired employees across Pakistan. With updated pension rates, digital CNIC verification, and expanded coverage for informal workers, the system is now more transparent and efficient.

By following the eligibility criteria and completing your verification process on time, you can enjoy a smooth pension journey and secure financial support for your post-retirement life.